Buying a property is one of the most significant financial decisions a person can make. It’s not just about choosing a home that fits your lifestyle, it’s about understanding the broader economic and market forces that influence property value, mortgage rates, and long-term financial stability. Whether you’re a first-time buyer or an investor, having a clear understanding of current market trends can mean the difference between a smart purchase and a costly mistake.

Market trends reveal the direction of property prices, supply and demand levels, and interest rate fluctuations. By studying these patterns, buyers can identify the right time to purchase, negotiate effectively, and avoid overpaying.

Table of Contents

Reading Market Indicators for Smarter Decisions

Successful property buyers often act like investors, they rely on data and trends rather than emotion. Understanding key market indicators, such as median home prices, inventory levels, and average time on the market, helps predict future conditions. For example, a rise in available listings may suggest a cooling market, giving buyers more leverage, while a limited supply with rising prices often signals strong competition.

Interest rates are another critical factor to monitor. When rates are low, buying power increases because mortgages become more affordable. Rising rates can limit affordability, influencing both price negotiations and long-term financial planning. Regional employment growth, infrastructure projects, and population movement contribute to property value trends, helping buyers choose locations with the highest potential for appreciation.

Understanding how these variables interact can help buyers create strategies for purchasing and for financial management afterward. Once you secure a property, researching financial resources, such as how to pay off your mortgage faster, can strengthen your investment return. Combining market awareness with smart financing decisions leads to sustainable, long-term property ownership.

Timing the Market to Maximize Value

While it’s impossible to predict every market fluctuation, certain patterns help identify favorable windows for buying. Seasonality plays a role, spring and summer often bring more listings but higher competition, while winter months may present better deals due to fewer active buyers. Watching economic indicators like inflation, interest rate policies, and consumer confidence levels can provide valuable timing insights.

Buyers who track long-term property cycles, periods of growth, stagnation, and correction, are better prepared to navigate risk. Purchasing during a downturn or early recovery stage can yield significant benefits when the market rebounds. Patience, supported by data, often results in acquiring properties with higher future returns and lower initial costs.

However, “timing the market” doesn’t mean waiting endlessly for perfect conditions. Instead, it’s about recognizing opportunities that align with personal and financial goals. When combined with steady research and professional advice, this mindset helps buyers act with confidence rather than hesitation.

Location Trends That Influence Long-Term Growth

The real estate mantra “location, location, location” remains true, but understanding why certain locations outperform others is where real insight lies. Factors such as job growth, transportation access, school quality, and local development plans all shape demand. Cities investing in infrastructure, like public transit, green spaces, and digital connectivity, tend to attract higher property values.

Emerging neighborhoods offer unique advantages. As urban centers expand, adjacent areas often see rapid development and appreciation. Early investment in these zones can lead to substantial long-term gains. Buyers who analyze demographic data, zoning updates, and planned construction projects position themselves to capitalize on future growth before prices surge.

The Role of Technology and Data Analytics

Technology has revolutionized how buyers assess market trends. Online platforms now provide real-time updates on price movements, rental yields, and buyer sentiment. Data analytics tools help visualize long-term trends, making it easier to compare neighborhoods or evaluate investment opportunities.

Virtual tours, AI-driven property recommendations, and predictive models give buyers access to insights once reserved for professionals. Understanding how to use these tools effectively enables faster decision-making and better comparisons between properties.

Working With Professionals Who Understand the Market

Navigating real estate trends can be overwhelming without expert guidance. Real estate agents, mortgage brokers, and property consultants interpret complex data and provide localized insights. Their understanding of market timing, negotiation strategies, and financing structures can save buyers from common pitfalls.

Experienced professionals recognize subtle patterns that raw data might miss, such as shifting neighborhood preferences or hidden costs associated with older properties. Collaborating with knowledgeable advisors ensures that every decision aligns with both market conditions and long-term financial health.

Adapting to Future Real Estate Trends

The property market never stands still. Economic cycles, climate change, remote work, and digital transformation all continue to reshape housing demand. Buyers who stay adaptable and informed will thrive, even during unpredictable market shifts.

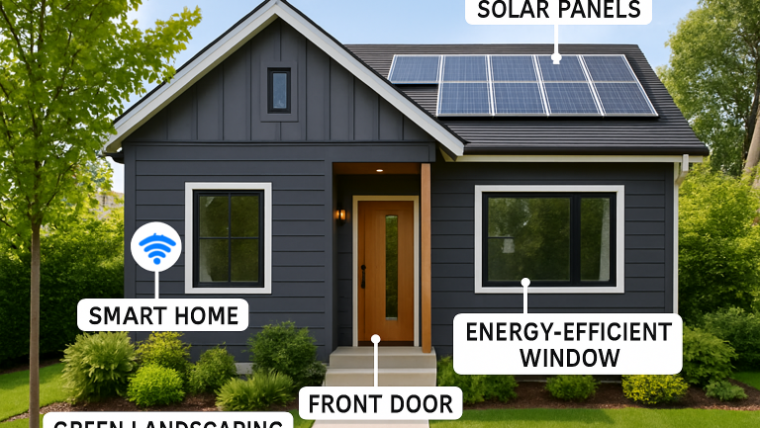

Remote work trends have increased demand in suburban and rural areas, while sustainability concerns are driving investment in energy-efficient homes. Understanding these shifts allows buyers to align their purchases with future lifestyle and value expectations.

Buying property isn’t just about owning real estate; it’s about making decisions that enhance financial freedom and stability. Staying informed about market trends ensures that every choice, from initial purchase to future refinancing, contributes to a sustainable and rewarding financial journey.